For a very long time, M&A transactions have been very popular among companies, since they have a synergistic effect that helps reduce the company’s costs. However, it is worth understanding what role the integration process plays in M&A transactions? What is the post-acquisition integration checklist?

What is post-acquisition integration?

Mergers and Acquisitions (M&A) is a common market tool for asset consolidation. Transactions of this kind can significantly improve the position of a new company in the commodity, credit, and stock markets, and increase its financial stability. But the association also has a “dark” side – conflicts arise more often in a mixed team, predictability in management decreases, productivity drops, etc.

Negative phenomena are especially typical in hostile acquisitions, because the acquiring party often underestimates the potential costs of integration, restructuring the management system, creating a new image, etc.

One of the criteria for the success of M&A is the effective integration of enterprises after the transaction. Research confirms that integration management errors are the main causes of deal failures. Post integration in each case has its specifics and requires an individual approach.

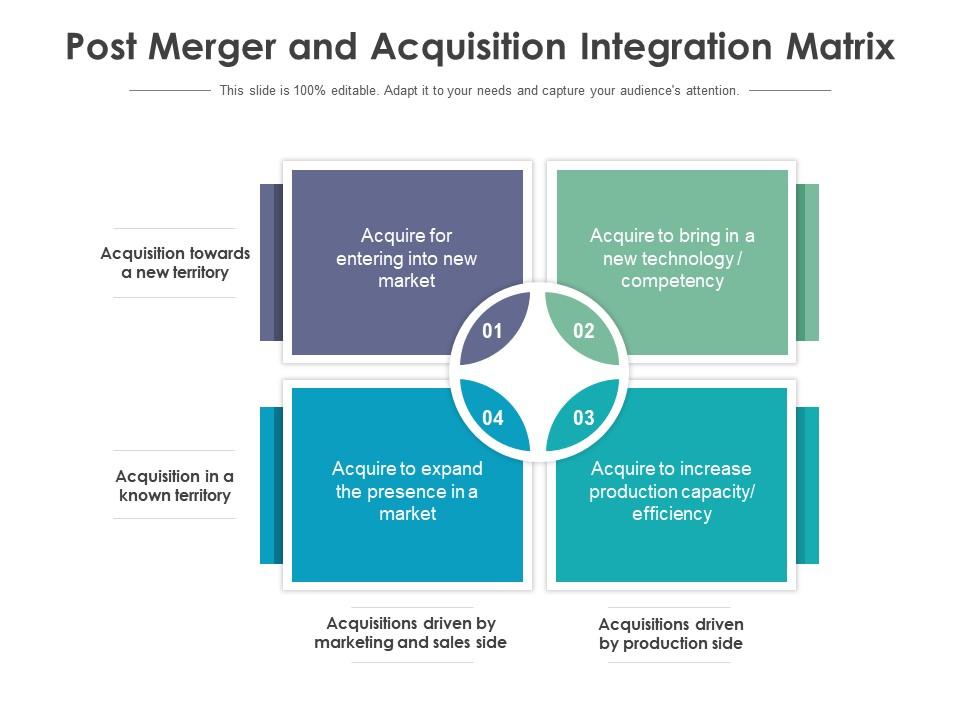

The most important decision that must be made by the management of an enterprise in an acquisition is the determination of the appropriate degree of integration. The degree of integration is the definition of the approach to integration, depending on the objectives, type of acquisition, and size of the enterprises involved.

Scenarios of M&A integration

From the point of view of the degree of intensity of communication between the target company and the acquiring enterprise, 3 scenarios for the integration of the merging enterprises can be distinguished:

- The stand-alone approach is aimed at promoting the acquired enterprise in the future as an independent unit. It is most effective for conglomerate acquisitions since such a combination of enterprises does not lead to significant advantages in the field of finance, accounting, etc.

- Absorption is a full integration of the acquired enterprise into the structure of the buyer’s enterprise.

- Best-of-both approach. In addition, this approach can be used when a large diversified enterprise acquires another enterprise to strengthen one of its areas of activity.

How to prepare for transaction?

Post-integration activities can be divided according to their objective content into different areas. In practice, there are 6 integration areas:

- Strategic integration refers to the process of harmonizing, as a rule, the different strategies of the enterprises that are involved in the acquisition. The tasks of strategic integration include: determining the future goals of the enterprise; formation of a business strategy; transfer of strategically important resources and capabilities.

- The essence of structural integration is the inclusion of the acquired enterprise with its entire structure and ongoing processes into a common enterprise. The management of the acquiring enterprise may decide that the acquired enterprise will exist as an independent unit.

- HR integration covers the coordination of all areas of personnel management of enterprises involved in the acquisition. It also includes measures for planning personnel policy, such as attracting and releasing personnel, developing incentive systems, remuneration, etc.

- With cultural integration, which is called acculturation, the cultures of the merging enterprises are adjusted to each other. Here 2 criteria are important in the process of acculturation: the attractiveness of the culture of the purchasing enterprise and the desire to preserve its own culture.

- The task of operational integration is to harmonize all areas of production and provision of services of enterprises participating in the takeover.

- External integration involves effective communication with the various stakeholder groups involved in the acquisition process: customers, suppliers, investors, analysts, and the public.